Host Hotels & Resorts Inc. HST has acquired a fee simple interest in The Alida, Savannah, for approximately $103 million in cash. The 173-room boutique hotel was opened in October 2018 and continues to benefit from soft branding in Marriott’s Tribute Portfolio.

– Zacks

– ZacksHost Hotels expects stabilization for The Alida in 2024-2025 with roughly 11-12x earnings before interest, taxes, depreciation, and amortization (EBITDA) and expects it to deliver roughly $240 of revenue per available room (RevPAR). The stabilized EBITDA for the property is in line with Host Hotels’ estimate of normalized 2019 operations and adjusts for construction disruption to the surrounding Plant Riverside District and the initial ramp-up of the hotel operations.

The property is situated in Savannah’s historic district and is adjacent to a newly developed entertainment district, which includes the Plant Riverside District. Savannah is a drive-to leisure destination for fast-growing markets in the Southeast and enjoys increasing number of travelers through the Savannah/Hilton Head International Airport. Hence, with the resumption of travel and recovery in leisure demand, the acquired hotel is likely to attract leisure travelers.

The hotel offers 11,570 square feet of meeting space, four F&B outlets with a rooftop bar, an outdoor pool and a street-front retail space. Besides, the property will provide a $271-million convention center expansion to be completed in 2024. This will enable the property to attract in-house and out-of-house group demand, and offers scope for higher group and business bookings.

In addition, Host Hotels is making efforts to enhance its portfolio quality through dispositions of non-strategic properties. It sold leasehold interest in the 305-room W Hollywood for a total sales price of roughly $197 million, which includes $3 million for the furniture, fixtures & equipment replacement funds. The sale price reflects a 25.0x EBITDA multiple on 2019 EBITDA, consisting nearly $33 million of estimated foregone capital expenditures over the next five years.

Per management, “We continue to be very active on the capital allocation front as we target new markets. Year to date, we have invested $1.3 billion in early-cycle acquisitions. The blended EBITDA multiple on our six hotel acquisitions in 2021 is 12.9X, which compares favorably to the nearly $750 million generated from our six hotel dispositions at a 16.0X EBITDA multiple, including foregone capital expenditures.”

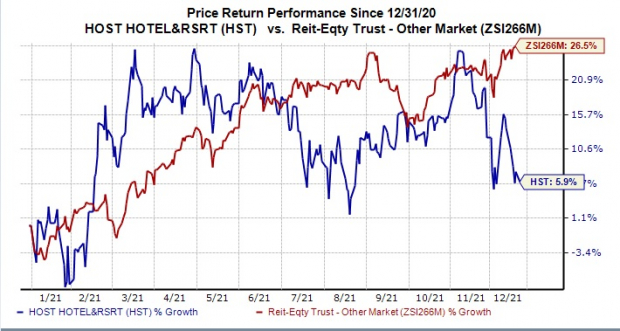

Shares of this currently Zacks Rank #3 (Hold) player have appreciated 5.9% year to date, underperforming the industry’s rally of 26.5%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the REIT sector are OUTFRONT Media OUT, Cedar Realty Trust CDR and Condor Hospitality Trust CDOR.

The Zacks Consensus Estimate for OUTFRONT Media’s 2021 fund from operations (FFO) per share has been raised 13.8% over the past two months. OUT’s 2021 FFO per share is expected to increase 45.71% from the year-ago quarter’s reported figure.

OUTFRONT Media flaunts a Zacks Rank 1 (Strong Buy) at present. Shares of OUT have gained 21% year to date.

The Zacks Consensus Estimate for Cedar Realty’s current-year FFO per share has been raised 2.6% to $2.36 in the past two months. Over the last four quarters, CDR’s FFO per share surpassed the consensus mark twice and missed the same on the other two occasions, the average surprise being 6.4%.

Currently, CDR sports a Zacks Rank of 1. Shares of Cedar Realty have appreciated 120.7% year to date.

The Zacks Consensus Estimate for Condor Hospitality Trust’s 2021 FFO per share has been raised 25.8% over the past two months. CDOR’s 2021 FFO per share is expected to increase significantly from the year-ago quarter’s reported figure.

Condor Hospitality carries a Zacks Rank of 2 (Buy) at present. Shares of CDOR have soared 101.7% year to date.

Note: Anything related to earnings presented in this write-up represent FFO — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Host Hotels & Resorts, Inc. (HST): Free Stock Analysis Report

Cedar Realty Trust, Inc. (CDR): Free Stock Analysis Report

OUTFRONT Media Inc. (OUT): Free Stock Analysis Report

Condor Hospitality Trust, Inc. (CDOR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Host Hotels (HST) Acquires The Alida Hotel for $103 Million

Source: Manila Trending PH

0 Comments